When states manage their finances effectively, they are more likely to have money to invest in priorities such as schools, health care, and infrastructure. When they don’t, they may be forced to cut spending and raise taxes to pay off long-standing expenses and provide basic services to citizens.

To help states manage uncertainty, adapt quickly when crises arise, and ensure that their budgets are balanced over the long term, The Pew Charitable Trusts provides data, analysis, and guidance to policymakers on a range of fiscal and economic issues. We also aid states as they design, evaluate, and improve business tax incentives and other economic development programs to ensure that these programs are cost-effective, helping businesses grow and workers thrive. Through research and advocacy, we help states identify potential policy approaches and make informed choices about what works best for their communities.

Our research—including 50-state assessments—examines key trends in state finances and evaluates states on their performance, underscoring effective approaches and creating an environment for potential reform.

We collaborate with policy leaders in states in a variety of ways:

-

Research: We conduct comprehensive and policy-relevant research. Our findings give states evidence-based options to address their unique fiscal challenges.

-

Information sharing: We serve as a resource to policymakers making research-driven decisions to improve fiscal outcomes in their states. We lead webinars, events, and meetings, and provide communications assistance to encourage state, regional, and national conversations on budget policies and practices.

-

Technical assistance and policy advocacy: We provide strategic technical assistance to states seeking to improve their budget practices. Our capabilities encompass policy design, including state comparative analysis; drafting or advising on legislation; offering testimony; and supplying other assistance, as requested.

Through these strategies, our goal is to help policymakers manage economic and revenue volatility, enhance transparency, and improve their states’ fiscal health over the long term.

Our Work

Article

April 25, 2025States’ Medicaid Costs Grow Even Before Potential Federal Cuts

Congressional budget plans could set the stage for hundreds of billions of dollars in federal cuts to Medicaid and the Children’s Health Insurance Program (CHIP), the joint state-federal programs that...

Article

March 27, 2025State Rainy Day Fund Growth Slowed in Fiscal 2024

After years of rapid expansion, growth in state rainy day funds slowed in fiscal year 2024. Although the median rainy day fund balance increased by 7% in fiscal 2024, that still marked a steep drop from...

Article

March 27, 2025State Tax Revenue Is Becoming More Volatile

State tax revenue volatility has increased in recent years, with significant fluctuations not only in total collections but also across major tax streams. From fiscal year 2019 to fiscal 2023, annual tax...

Article

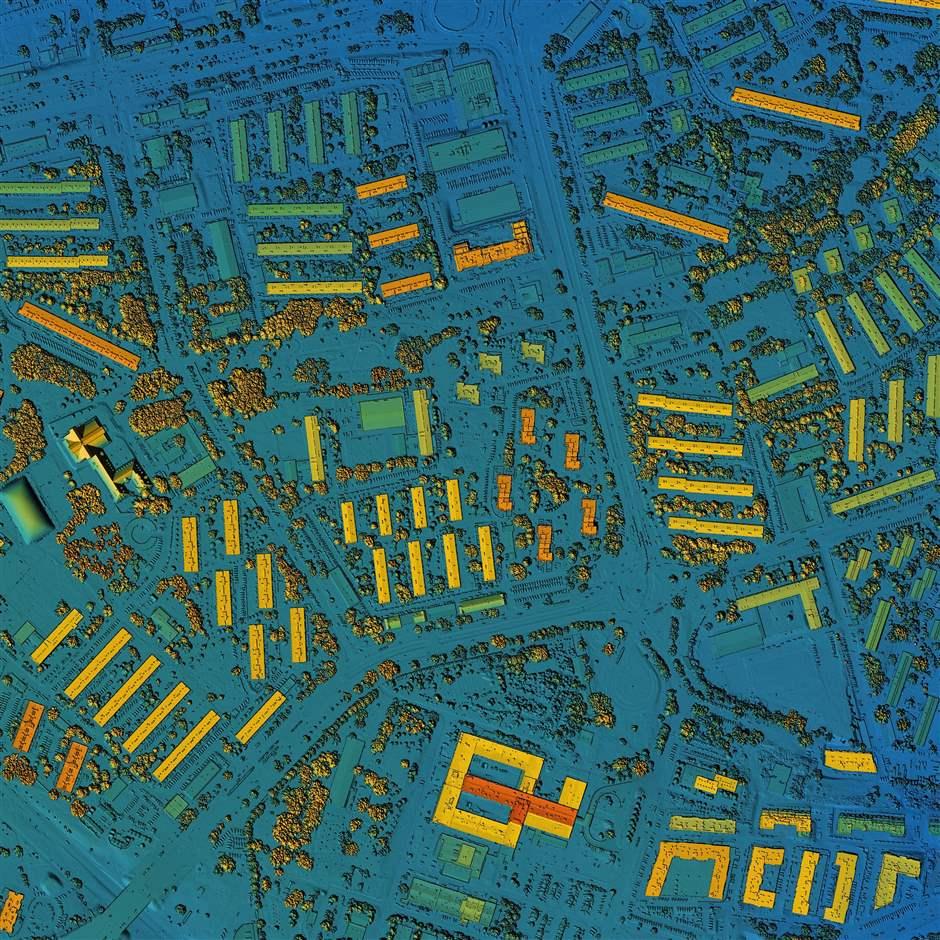

March 27, 2025Geographic Information Systems Can Help Measure Impact of Economic Development Incentives

How can the use of geographic information systems (GIS) help state policymakers evaluate the effectiveness of economic development incentives? The systems, known for their ability to store and represent...

Opinion

March 19, 2025How Shifting Demographics Are Reshaping State Finances

It’s a truism that demography is destiny—and that includes the financial destiny of states. Although the population of the 50 states grew at its fastest rate in nearly a quarter of a century last year...